what is sales tax in tampa

Perfect answer Does Tampa have local tax. This includes the rates on the state county city and special levels.

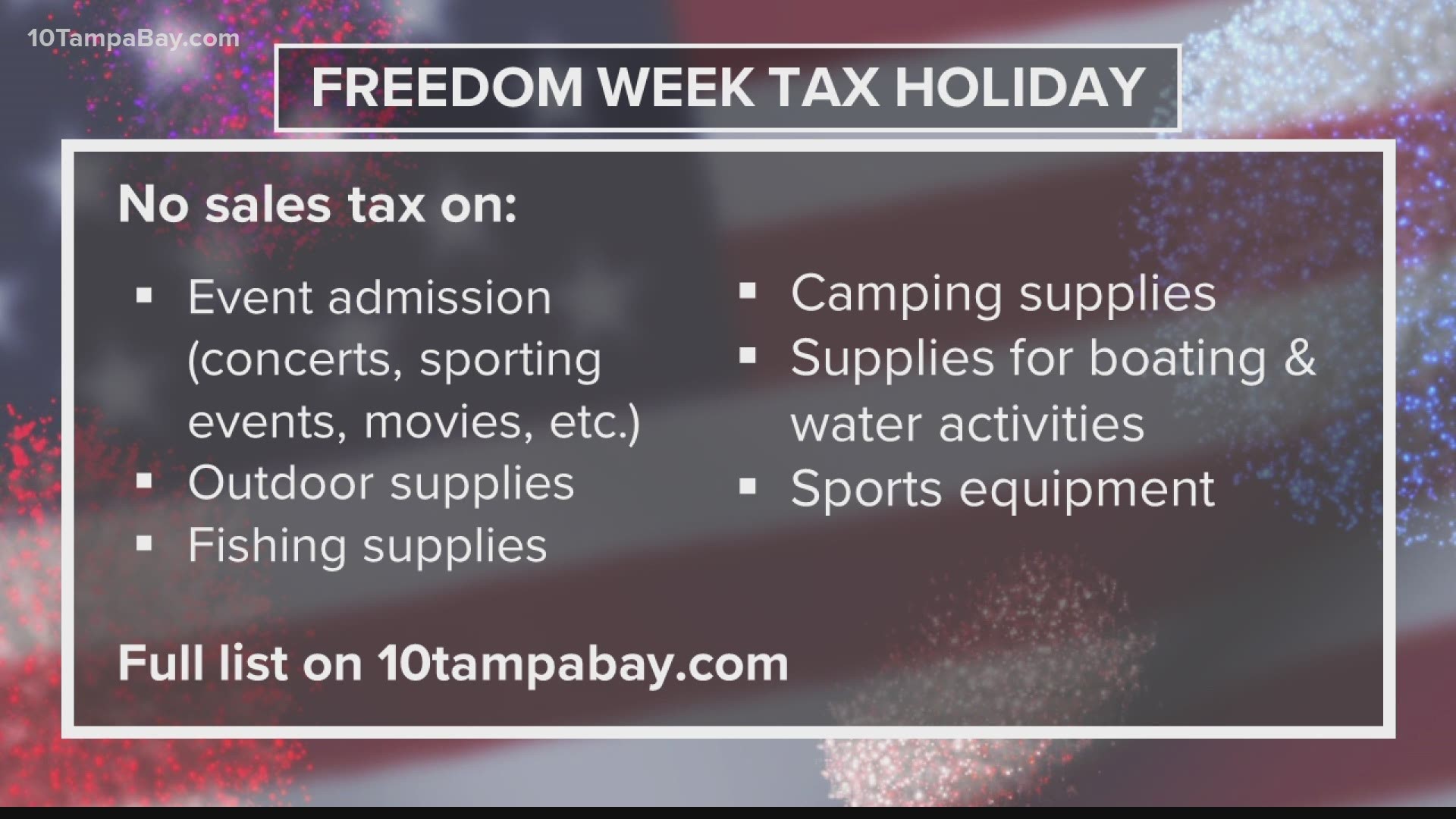

What Is Tax Free During Florida S Freedom Week Wtsp Com

You can print a 75 sales tax.

. The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665. The current total local sales tax rate in Tampa FL is 7500. The Florida state sales tax rate is currently.

Has impacted many state nexus laws and sales tax collection. There is no applicable city tax or special tax. The average cumulative sales tax rate in Tampa Florida is 75.

What is the sales tax rate in Tampa Florida. Florida imposes a variety of taxes including state income tax corporate income tax sales tax and local sales tax. This is the total of state county and city sales tax rates.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. With local taxes the total sales tax rate is between 6000 and 7500. The 75 sales tax rate in Tampa consists of 6 Florida state sales tax and 15 Hillsborough County sales tax.

Lemon Street Municipal Office Building. What salary does a Sales Tax earn in Tampa. 4900 W Lemon Street.

732 rows Combined with the state sales tax the highest sales tax rate in Florida is 75 in the cities of Jacksonville Tampa Tallahassee Tampa and Kissimmee and 94 other cities. What is the Florida sales tax rate for 2020. 551 Sales Tax Salaries in Tampa provided anonymously by employees.

The 2018 United States Supreme Court decision in South Dakota v. Floridas general state sales tax rate is 6 with the following exceptions. What is the sales tax rate in Tampa Palms Florida.

In terms of tax rates Florida has a fairly good tax code. Business Tax Supervisor. While Florida has a sales tax of 6 the actual sales tax for a vehicle in this state depends on the exact city you are in.

Tampa is located within Hillsborough County Florida. The Hillsborough county and Tampa sales tax rate is 75. The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665.

Florida FL Sales Tax Rates by City The state sales tax rate in Florida is 6000. That includes the FL sales tax rate of 6 and the countys discretionary sales tax rate of 15. Groceries and prescription drugs are exempt from the Florida sales tax Counties and cities can.

The state sales tax rate in Florida is 6000. Local governments can collect up to 15 additional sales. The minimum combined 2022 sales tax rate for Tampa Palms Florida is.

The Hillsborough County sales tax rate is. The 2018 United States Supreme Court decision in South Dakota v. Floridas general state sales tax rate is 6 with the following exceptions.

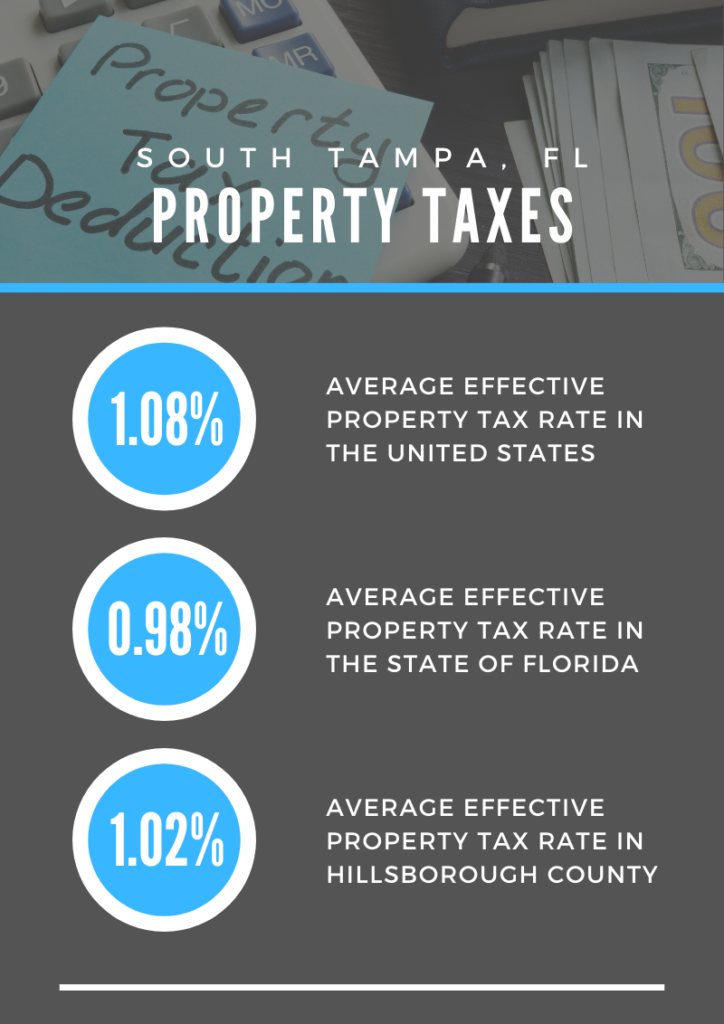

This includes the rates on the state county city and special levels. The estimated 2022 sales tax rate for 33606 is. What is Hillsborough County.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. The minimum combined 2022 sales tax rate for Tampa Florida is. Contact 306 East Jackson Street Tampa Florida 33602 813 274-8211.

Florida has recent rate. With local taxes the total sales tax rate is between 6000 and 7500. This is the total of state county and city sales tax rates.

The December 2020 total local sales tax rate was 8500.

Hillsborough Could Have Florida S Highest Sales Tax After The Nov 6 Election Will It Matter

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Sales Tax What Will Be The Effect Of The Supreme Court Tax Decision

New Laws Take Effect Jan 1 In The State And Tampa Bay Area Tampa Bay Business Journal

Florida S Back To School Sales Tax Holiday Begins July 25 Wfla

Morning Briefing Tampa Aug 2 2022

Who Controls Florida School Sales Tax Referendums

Property Taxes In South Tampa Fl Your South Tampa Home

With Hillsborough S 1 Cent Tax Ruled Unconstitutional How Does That Affect The County S Transportation Issues Wusf Public Media

Florida S Back To School Sales Tax Holiday What To Know Before You Shop

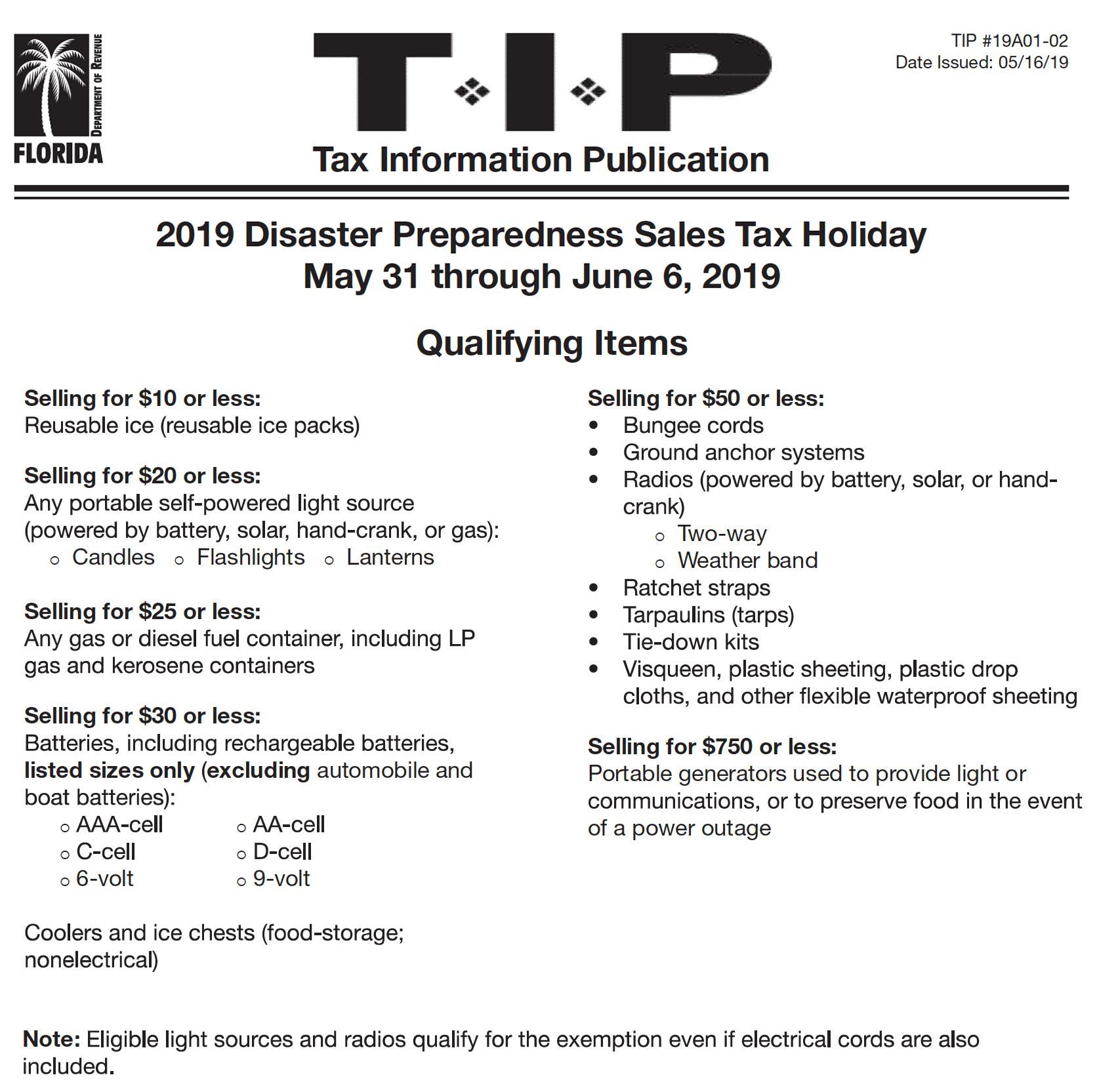

Us National Weather Service Tampa Bay Florida Starting Tomorrow June 1st Through June 7th The State Of Florida Will Be Giving A Sales Tax Holiday For Disaster Supplies The General List

Florida Sales Tax Small Business Guide Truic

Deal Reached To Lower Florida Business Rent Tax Tampa Bay Business Journal

Baby Diapers Will Soon Be Tax Free The Tampa Bay 100

Hurricane Preparedness Supplies Are Tax Exempt May 31 June 6th Tampa Hillsborough Expressway Authority

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Sales Tax Holidays Politically Expedient But Poor Tax Policy 2017